Behind Westpac's latest step

During 2020’s COVID19 lockdown, Westpac wanted to boost the cashflow of NZ’s SME businesses - by paying them faster.

On this page

The challenge

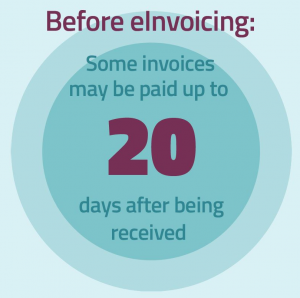

Westpac and their suppliers have agreed payment terms, meaning that invoices are paid in payment cycles that could be 20 days from invoice date. There were delays in getting invoice data into Westpac’s systems, and inaccuracies from manual input or invoice scanning - which could take even longer if an invoice was left sitting in the business area.

The solution

Westpac made a series of changes including improving internal processes and removing payment terms - meaning that SME suppliers were paid as soon as an invoice was processed. Next, they implemented eInvoicing which allows accurate invoice data to go directly into their systems. Westpac became eInvoicing enabled through Basware, the provider of their existing procure-to-pay (P2P) system. This was a seamless process compared to alternatives like acquiring new technology.

Then they emailed suppliers known to have eInvoicing capability (particularly Xero and MYOB users) asking them to send eInvoices instead of PDF invoices. Receiving eInvoices further reduced delays in receiving the invoice and allowed Westpac to pay their suppliers faster – typically within 2-3 days.

And with the volume of eInvoices Westpac receives each month continuing to grow (to nearly 500 in May 2023, a quarter of all their invoices), more and more of their suppliers can benefit from faster payment.

Text description

Text description

Sign up, to stay ahead

If you’re a business owner, accountant, business advisor or manager – or you just want to stay in front of the eInvoicing curve – sign up here for email updates, seminar/webinar invitations, and tips to get maximum value from eInvoicing.